Media businesses are facing their most difficult moment ever, Politico and Axios co-founder Jim VanderHei recently said as he ticked off challenges in audience acquisition and monetization. To compete, publishers have focused on understanding audience needs to refine their products to drive engagement and reader revenue.

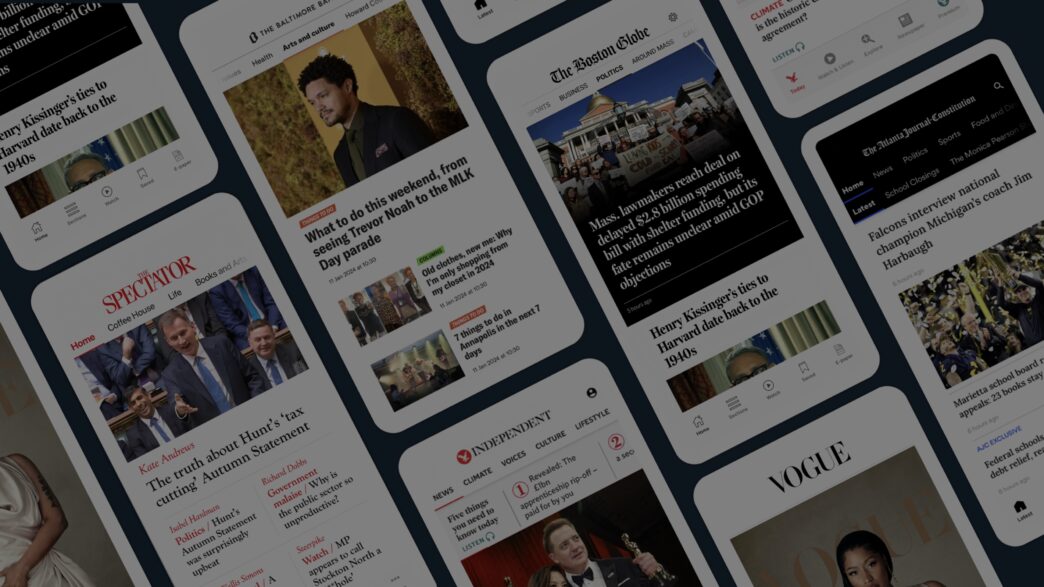

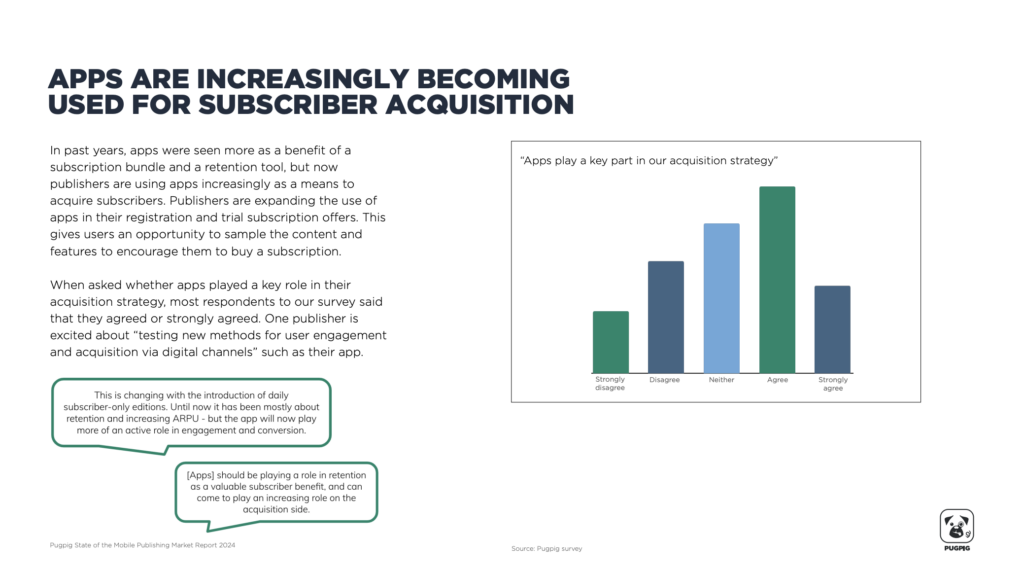

Against this backdrop, the role of apps is shifting as publishers take advantage of their traditional retention benefits while looking to develop them further to acquire new subscribers and engage new audiences, according to Pugpig’s latest State of Mobile Publishing Report.

The report draws on industry insights, exclusive analytics data from the hundreds of apps Pugpig builds and a survey of more than 70 publishers. It provides actionable intelligence on how publishers can grow the audience and engagement for their apps, new opportunities with apps to increase first-party data and future app features that publishers believe will deliver on their editorial and business goals.

TL;DR report highlights:

> Mobile is the dominant platform for audiences, and its use is stable or growing across major markets around the world

> News and magazines has been a fast-growing segment amongst non-gaming apps, in terms of both downloads and revenue

> There has been an explosion in demand for AI chat and image generation apps, and the technology has a halo effect, as apps with AI features benefit from the surge in interest in artificial intelligence

> First-party data is a priority for publishers, and many use their apps to collect their own data

> Publishers see an opportunity to take advantage of regulators pushing Google and Apple to open their app stores, allowing them to keep more revenue and capture more data about their subscribers

> Push notifications are a killer feature for apps, offering a unique path to direct engagement

> Audio, puzzles and digital editions deliver high levels of engagement, and publishers should lean into these formats to build loyalty and habit with audiences

> Publishers plan to develop apps with richer, more personalized content and deeper community and interactive features. Publishers are already launching apps with high-touch membership features to increase revenue

Optimistic, despite challenges

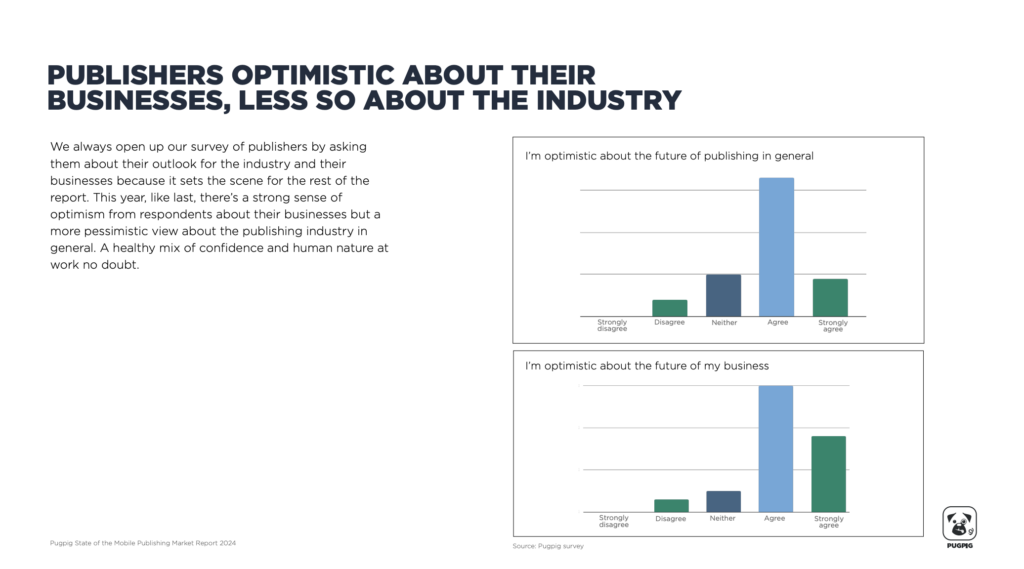

One publisher we surveyed succinctly summarized their challenges, which mirror those of the wider industry: “Rapid declines in audience and revenue, challenges through the changing digital ecosystem thanks to the rise of AI and decline of social traffic.” Publishers told us that the lingering effects of inflation have made subscribers more price-sensitive, which makes it difficult for them to raise prices for those on discounted offers. Ad demand and falling digital ad yields were also eating into their top line.

Despite it all, publishers remained optimistic that they would weather this storm, although less so than in our previous report, and they are pessimistic about the publishing industry overall.

AI has added to this period of disruption, but the perception of its impact is mixed. Publishers are concerned that AI-powered search will erode what is currently a reliable traffic source.

However, publishers are also optimistic that AI can give as much as it takes from them. AI dominates their innovation agenda, as they look to a suite of AI technologies to drive efficiencies and deliver new value for audiences through personalization and AI-generated summaries, which have shown promise in engaging young, mobile audiences.

A focus on retention, experimentation with acquisition

Apps have traditionally been seen as part of publishers’ retention strategies, and retention replaced acquisition as the top priority in our latest survey of publishing professionals.

However, the well-known challenges in audience development driven by changes in search and social are driving publishers to experiment with apps as audience acquisition tools.

Publishers are using advanced data tools to monitor how their apps are being used and what drives subscriber conversion. The Baltimore Banner in the US uses BlueConic to track what content users engage with, which app features they engage with and which newsletters they are subscribed to, Eric Ulken, VP of Product at The Baltimore Banner said it allows them to correlate activity that leads to conversion or retention, and that data is changing how they view the app in the context of their subscription strategy. “We tend to see the app as a retention play, largely. I think increasingly we’re starting to understand the value that it has further up the funnel,” he added.

The Baltimore Banner is gathering and leveraging first-party data in the app through their use of external link entitlement (ELE), which allows them to direct iOS users to their own subscription journey. ELE allows them to avoid paying Apple 15-30% of their subscription revenues and gather first-party data from their users.

While publishers have to apply to Apple to implement ELE, most of the publishers in our survey said they were interested in exploring the option.

> To read next: how to maximize reader engagement on mobile apps

Push Notifications: The killer feature of apps

Using their data, The Baltimore Banner found “a strong correlation between regular use of the app and retention”, Eric said.

For the report, we analyzed the product features responsible for users’ high engagement with apps. We found:

- A minority of app users are puzzle fanatics, but these users are extremely regular.

- Audio again plays a minority role in terms of the users of most apps, but audio users spend a lot of time in an app. Looking at one high-performing app, we found that audio users spent 2.5x more time in the app than non-audio users.

Encouraging more people to use these features will help support subscriber retention.

Publishers also find that push notifications offer a unique opportunity to engage audiences.

“It is the only platform that we are able to push, bring people in, without having to voluntarily follow a link. Newsletters to an extent yes, but push notifications are more effective in bringing people back,” Eric Ulken, VP of product at The Baltimore Banner said.

In analyzing data for the report and working with our customers, we have seen one publisher increase engagement with their app by 60% simply by starting to use push notifications. According to data from the apps we build, publishers with high-performing push notification strategies, which had average open rates of 2.55%, had more than twice as much engagement when measured by sessions per user per month than publishers with low-performing strategies.

The future of apps

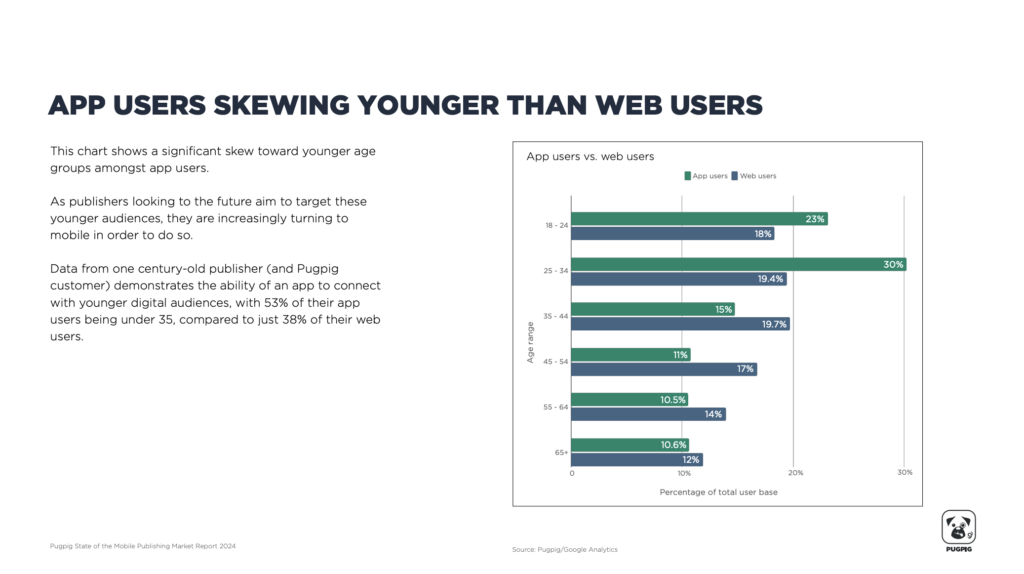

With mobile being the primary platform for most countries, publishers see apps becoming more central to their strategies. They also saw apps allowing them to reach audiences they currently don’t, including younger audiences. Pugpig data shows the opportunity apps present to reach younger audiences. For one century-old publisher, 53% of their app users are under 35 compared to just 38% of their web users.

They also plan to develop their apps further to increase engagement. B2B publishers want to leverage valuable industry data with real-time dashboards and other interactive data features. Consumer publishers plan to increase the range and variety of content they publish in apps and use personalization so that audiences can quickly find relevant content in their apps.

Several publishers have already added commenting functionality to their apps and are considering adding richer community features to support higher-revenue membership offerings.

Hearst UK has launched new apps as a key element in its premium membership strategy. Women’s Health Collective and Men’s Health Squad members have access to members-only content including training plans they can use at the gym on their smartphones.

“The new apps and enhanced membership offerings will allow us to create even stronger and deeper relationships with existing and new members, whilst building more opportunities for the future with premium content that people want to pay for,” David Robinson, Chief Customer Officer at Hearst UK, said.

The report also covers how publishers can take advantage of changes in the regulatory landscape that are opening up Apple and Google’s app stores, and we look at the impact of AI on mobile apps. It is available for download now.