Pulling together analytics aggregated across a sample of Pugpig’s 350+ media brands and augmented with industry data, the report shares valuable insights into how readers are consuming content (particularly on mobile) and how publishers are responding to their needs. Download the full report here, and find our 5 key takeaways below.

1. Whilst most digital habits have fallen back to pre-pandemic levels, mobile use continues to grow

When designing products for mobile, phones are rightly the starting point, but it’s important to consider the other screens that may be in your readers’ hands.

Tablet usage, while still a small percentage of total usage, is still important, particularly with consumer media, so it’s vital to design both your apps and content with that in mind.

Not only that, but given the popularity of keyboards on tablets, landscape designs are also important to factor in..”

Did you know that whilst the majority of traffic is accessing your content on mobile devices, these users only make up a small percentage of user-to-subscriber conversion rates. Find our analysis and recommendations for optimizing conversion rates on mobiles in our article.

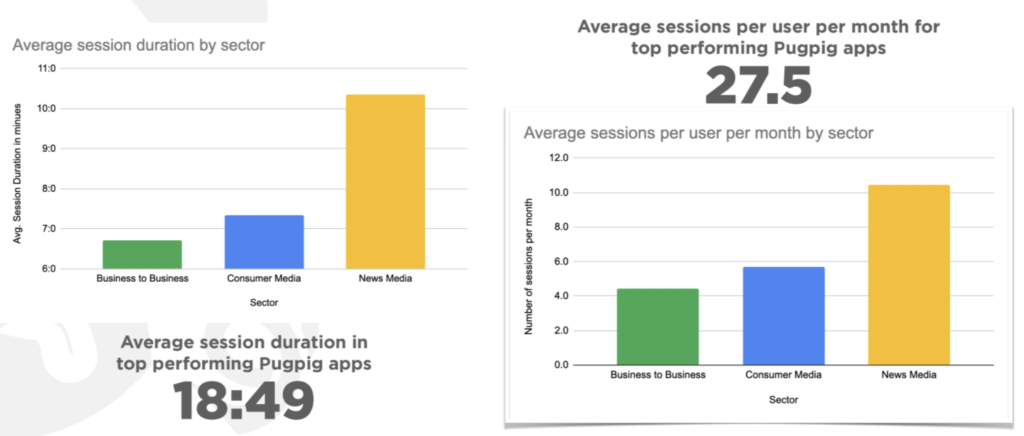

2. Time spent on apps has grown by almost an hour a day since 2019, and whilst websites still deliver the largest audiences, apps have the most engagement

Apps are super sticky, and daily newspapers are ahead of the game in engaging audiences via mobile applications.

But website visits on mobile (over apps) still deliver the largest audiences.

This higher engagement also applies to in-app subscriptions, both in terms of session duration and average sessions per month.

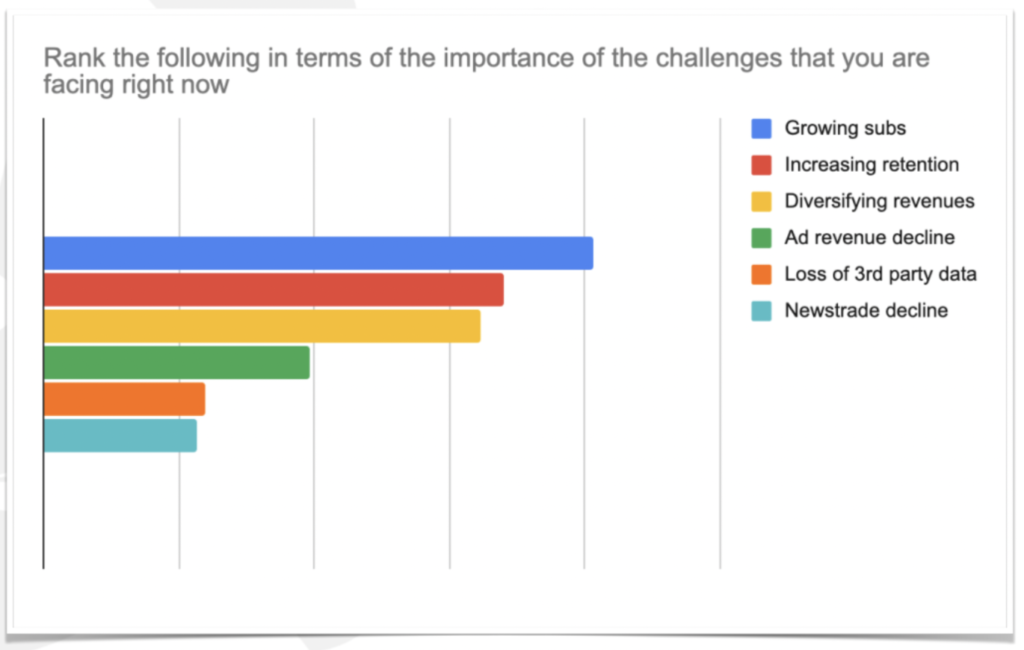

3. Key challenges for the media leaders interviewed include subscription, retention, rising costs and competition for talent

Growing subscriptions is the biggest challenge, but retention was a close second as publishers try to keep hold of readers who converted during the pandemic.

Recruiting talent and trust were two other key challenges for publishers interviewed:

The other challenges are about retaining talent and trust. Publishing has become much more about star talent. It’s a real pinch point for publishers because the rewards are often elsewhere… stars are the real attraction for subscribers.”

4. Two areas of innovation stand out for research participants: personalization and audio

Media leaders spoke about a number of different personalization approaches:

- Automated recommendations and automated front pages that rely on artificial intelligence

- Content that is tailored to specific audience segments, either on the site, in the app, via a newsletter or push notification

- Many respondents spoke of segmented, multi-variant newsletters

- Content that is personalized based on users’ previous activity or expressed interests

These strategies will prove hugely valuable to engagement, conversion and retention efforts.

Publishers are also making better use of audio, a format that is proving itself as a driver for audience and revenue growth through subscriptions and novel strategies such as lucrative licensing deals.

Spoken Word Audio listening is growing. In the US, there has been steady growth over the last eight years.

And there’s been a massive shift to listening on mobile.

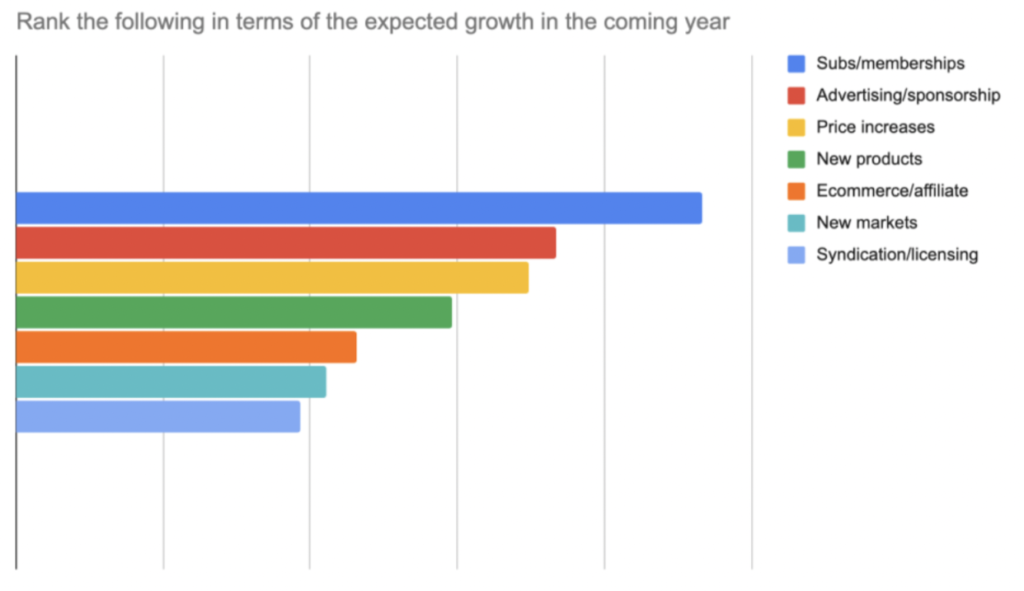

5. Subscriptions and memberships are expected to be the top revenue growth driver in 2023

Many of the media leaders we spoke to said subscriptions were the bedrock of their businesses.

Publishers also see price increases not only as a source of growth but also as a way to address inflation, which is driving up the cost of print production and distribution.

However, we were challenged over assumptions that advertising was in decline. “We see many publishers actually growing ad revenue and hoping to accelerate this growth with new products based on first party data,” Greg Piechota, with INMA, said.”

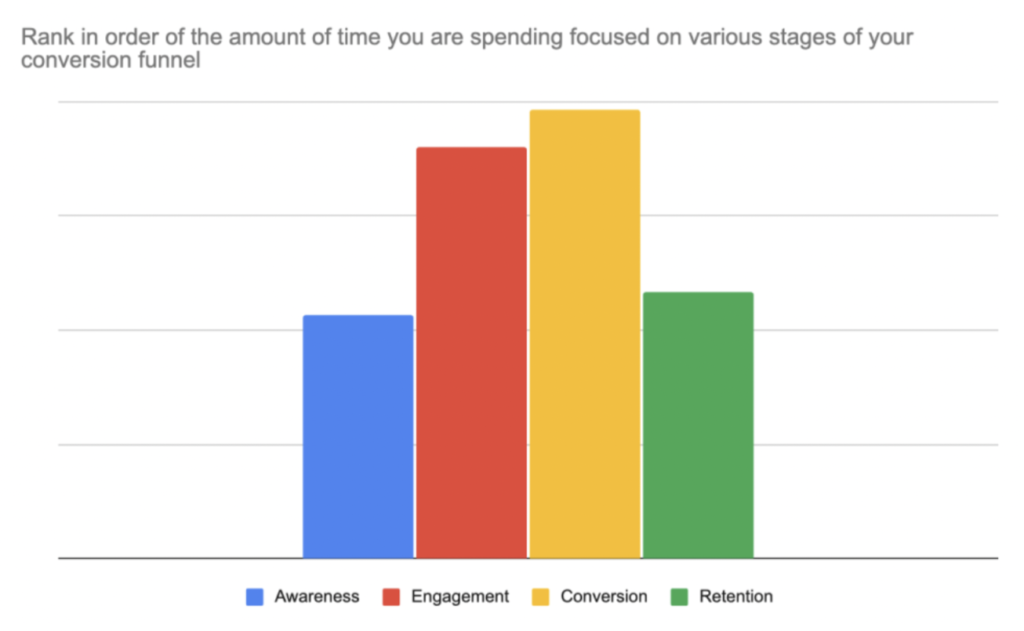

Where in the subscription funnel is the focus on?

More than half of our publishers are focused on engagement and conversion, showing how subscription growth was still their highest priority.

And with that focus on subscriber growth, many also spoke of increasing engagement that would lead to conversion. This played prominently in their rationale behind adding personalisation features to their digital content

Those who spoke about retention said that they had seen strong subscriber growth during the pandemic and wanted to hold onto those gains.”