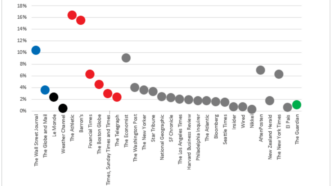

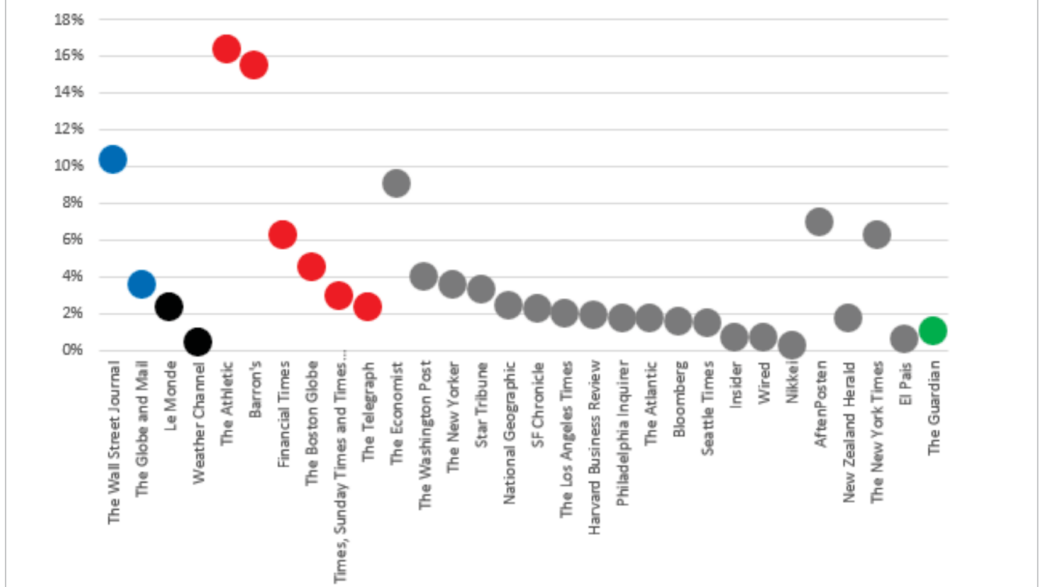

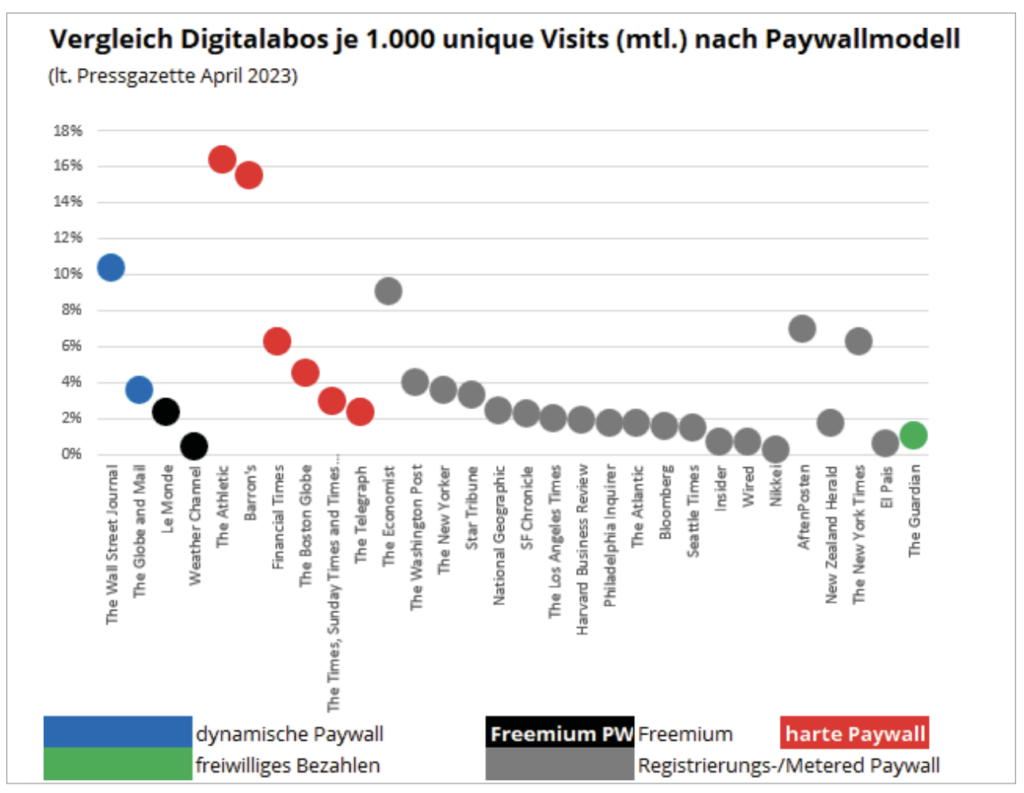

The B2B publication, Press Gazette, recently published a ranking of the best newsbrands at converting readers into paying subscribers, slightly modifying the benchmarking metric shared in my last article. Instead of comparing the number of website visits to the number of digital subscribers, Press Gazette measures the conversion success of paywalls by the number of unique website visitors, presenting the figure as a percentage value (subscribers in relation to website visitors) whilst the pv digest figure is ‘subscriptions per 1,000 website visits’. Their benchmarking article presents values for 23 English-language premium offerings and 7 selected prominent non-English media, with results ranging from 16.4% (The Athletic) to 0.2% (Nikkei).

What explains conversion success?

Press Gazette explains the range of factors that set apart newsbrands with higher conversion rates:

- The amount of time that a publisher has had a paywall in place, i.e. maturity in the digital subscription market

- The brand reach – for instance national titles seem to have added advantages over local brands thanks to a larger potential audience and more money for technology and subscription marketing than local papers

- The publisher’s overall business model, with those publications trying to generate digital advertising revenue alongside subscriptions, it’ll be harder to be at the top end of the reader revenue market compared to a publisher replying entirely on paid content

- Potentially, the paywall model too…

Does the paywall model impact conversion success?

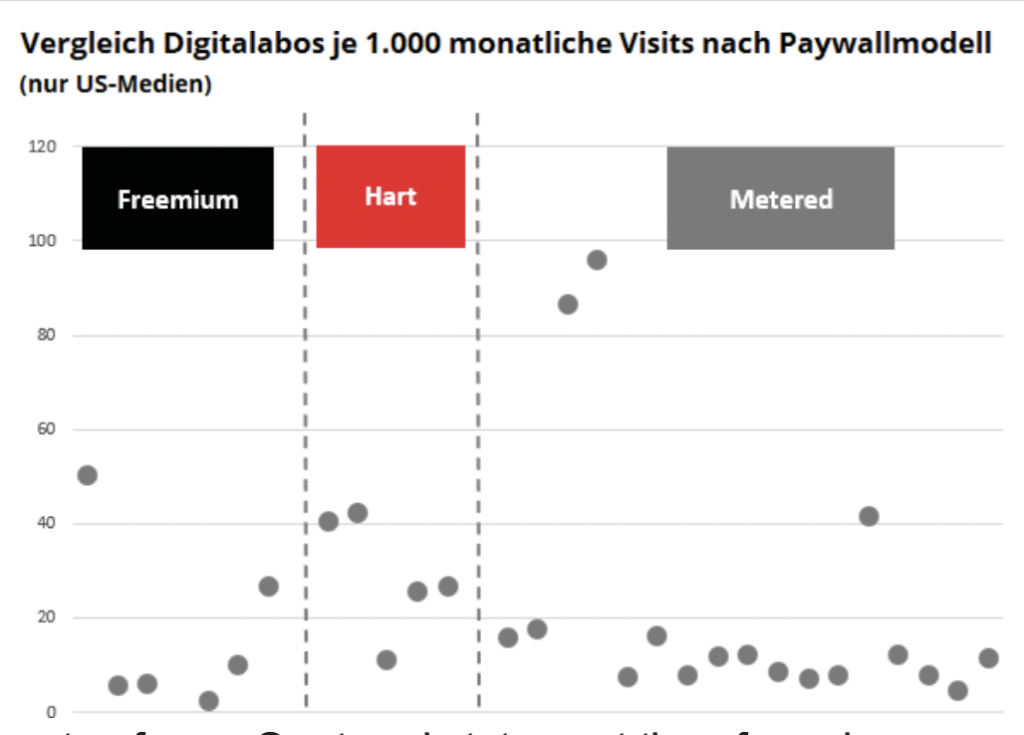

Moreover, Press Gazette’s list only includes 2 freemium paywalls, making statistical statements impossible. Nevertheless, we can read from the graph below that paywall model could well be a systematic cause of exploitation – hard paywalls achieve the highest values and metered paywalls achieve higher values on average than freemium models or voluntary pay.

Note that pv digest’s study doesn’t consider the dynamic paywall category in its analysis because of significant categorization problems.

Benchmarking 2.0 – how well do paid content providers convert their reach into subscribers?

Since the data from Press Gazette also indicates a correlation between paywall model and paywall success, we’ve taken a look at the significantly larger volume of digital subscription media included in FIPP’s Global Digital Subscription Snapshot (henceforth named GDSS).

This snapshot is the most comprehensive international listing of paid content offerings known to us, sharing information on the current number of active digital subscription for respective publishers. The collection included the most widely recognized offerings, from The New York Times to Bild and Le Monde, as well as a large number of medium-sized publishers and a few smaller media. This data is therefore not representative of the paid content industry, especially since the reported digital subscriptions are mostly based on publishers’ data, which do not meet uniform standards and are (for the most part) not independently verified. However, FIPP’s data collection is the most comprehensive picture of the reader revenue digital press market available.

For the following analysis, we enriched this data collection with our own data, gathered through systematically visiting the 142 media websites in the snapshot, noting the following:

- Whether a registration wall was also employed

- After clicking on the paywall, are we presented with a single or multiple subscription offers?

- Amongst them, which subscription offer involves the least commitment? – Is there a trial offer? If so, for how long, and what is the price of this trial?

- Does the paywall behave differently on mobile vs desktop?

- How many monthly visits does the offer reach? (current estimate by Similarweb)

- The paywall model (Freemium, hard, metered or voluntary)

On this final point, in order to assign a paywall model, we followed the following logic:

Freemium: parallel offering where content is divided into free and premium, i.e. content that is only available to paying subscribers. Items in the ‘premium’ category are often identified with a symbol.

Metered: no labelling on premium content but readers are given a quota of articles to read for free before being blocked. With this logic, publishers asking for account creation through a registration wall prior to the paywall have been included in this category

Hard: no content is available for free

In the case of 5 publishers, we classified the paywall as voluntary ( The Guardian, El Diario, Il Post, Der Standard & Daily Maverick). This was based on market knowledge and archive information from pv digest. As we’ve shown in previous reports, some of these examples increasingly blur the line to paid. Accordingly, this category should be treated with caution.

We were unable to determine the paywall model employed in 12 cases as no restrictions to content were identifiable. This could be because these publishers sell digital subscriptions only for their e-paper, or perhaps that they don’t make their offering available in Europe (usually because of European data protection rules).

In terms of geography of these publishers, it’s worth noting that the 142 publishers in the GDSS cover 39 countries. The country with the most media included is the USA (34 publishers), followed by Germany (16) – disclaimer: some data was contributed from the pv digest archive, which could play a role here. 3 GDSS paid content offerings are from Austria and only the NZZ is taken into account from Switzerland.

> You’ll also enjoy: Why subscriptions feel like a burden to young people

Comparison of the ‘best performing paid content providers’ in subscriptions /1,000 visits

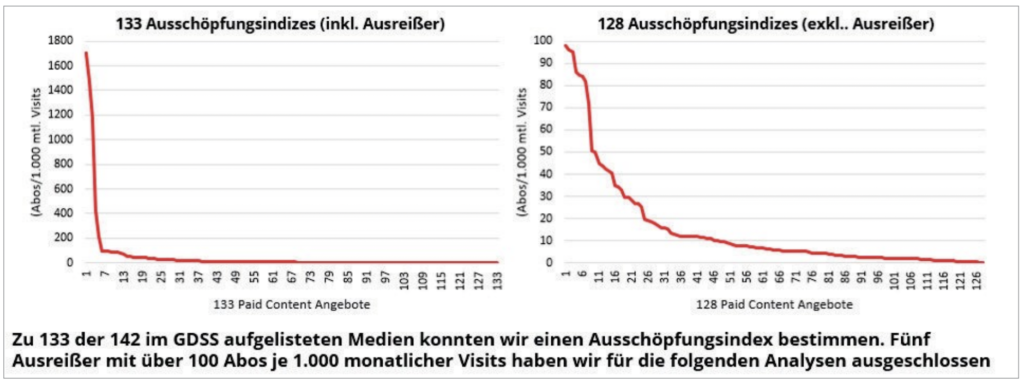

Out of the 142 paid content offerings, we were able to determine basic data for our exploitation index for 133 publishers – i.e. we had both information on the quantity of digital subscribers and an estimate of the reach from Similarweb. Our index is then calculated as subscriptions per 1,000 monthly visits.

This resulted in 5 outlier values, which we exclude for the following analysis because they seem implausibly high. The reason for this could either be because of an incorrect number of digital subscriptions in the GDSS or an estimation error from Similarweb. The remaining values are plausibly distributed over a still very large spectrum of 98 digital subscriptions per 1,000 monthly visits to 0.1 subscriptions…

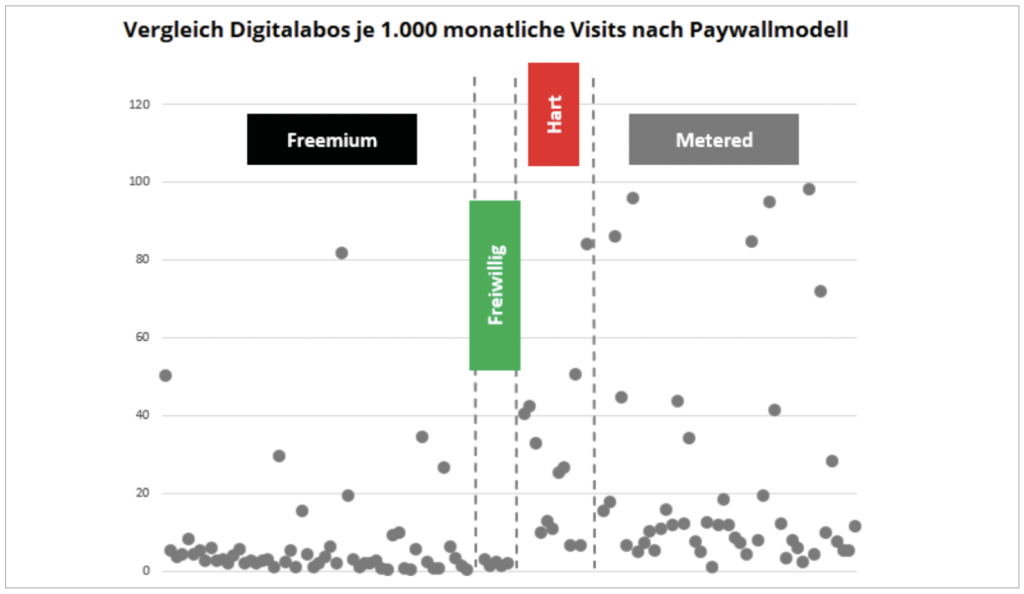

In terms of the paywall category, there are more or less as many freemium paywalls as metered paywalls in the sample. For these two models in particular, our analysis thus significantly broadens the database for answering the question about the model with the better exploitation performance.

Looking at the averages, the results are clear. The 54 freemium paywalls have an average of 7.6 subscriptions per 1,000 monthly visits. By contrast, the 45 publishers with a metered paywall achieve 23 subscriptions per 1,000 visits.

As shown by the graph below, which includes all 116 publishers with an identifiable paywall model, these differences aren’t based solely on the respective extreme values. In the large number of paid content providers with exploitable values below 20 digital subscriptions per 1,000 visits, the values for freemium paywalls are noticeable lower than those for metered paywalls.

Whilst the high performance of the hard paywalls is a banal finding (websites with hard paywalls are not very attractive for non-payers – the visits, to which we relate the number of digital subscribers here, are correspondingly low) and the low values for the only five models classified as voluntary are also not really surprising – the diagnosis remains clear even after considering this relatively large number of media spread across several countries and regions.

Metered models perform significantly better than freemium paywalls, supporting our findings in the first study.

However, it is still unclear whether this systematic difference is based on the actual superiority of metered over freemium. One factor that could be considered as an alternative explanation is the maturity of the publisher in their paywall model – more mature paywalls and offers tend to have gained more subscribers than younger ones. Since the freemium model only gained in popularity after the metered paywall, it could be that the superiority of metering is only an apparent one, because they are on average the older models. Further analysis is needed here that takes into account the ‘age’ of the paywalls. Our hypothesis, however, would be that adjusting for age wouldn’t eliminate the differences in performance between metered and freemium.

Another explanation is regional differences. Whilst freemium models dominate in Europe, metered models are the most popular choice for publishers elsewhere in the world. While we identified only 2 of 16 German paid content offerings being metered, all 5 paywalls in Brazil were metered. Unfortunately, our data isn’t comprehensive enough for a sound analysis of this regional factor.

Only in the US do we see enough paywalls of both types to perform a comparative analysis based on region.

Of the 34 US offerings, 17 have a metered paywall and 7 freemium. These metered paywalls from the US come to an exploitation index of 21.8. For the freemium models, the rate is 16.7. Our trend statement therefore also passes this detailed examination.